Take the guesswork out of opening Trusts, Estate accounts and more. Click on the account types below to learn what they are and view the documentation needed to open one.

A Revocable Trust, or Living Trust, is a Trust that can be changed by the Trust owner at any time. These changes may include removing or adding beneficiaries.

To open a Revocable Trust, please bring the following documents:

- Original Trust documents OR Certification of Trust

For Original Trust paperwork, the Credit Union will need to review the first page of the Trust, the Successor Trustee page and Signature/Notarized page.

Certifications of Trust must name Successor Trustee(s). - Social Security Number (SSN) or Employer Identification Number (EIN)

If using an EIN, copy of the IRS EIN letter is required.

To apply for an EIN, visit IRS.gov, search “Apply for EIN.” EINs are issued within a few minutes. - Account card (provided by the Credit Union)

All current acting Trustees must be present to sign account paperwork.

Once the Trust agreement is signed, an Irrevocable Trust cannot be changed.

To open an Irrevocable Trust, please bring the following documents:

- Original Trust documents OR Certification of Trust

For Original Trust paperwork, the Credit Union will need to review the first page of the Trust, the Successor Trustee page and Signature/Notarized page.

Certifications of Trust must name Successor Trustee(s). - EIN Letter

To apply for an EIN, visit IRS.gov, search “Apply for EIN.” EINs are issued within a few minutes. - Original death certificate (for creators of the Trust) and/or

- Proof of incapacitation, as outlined within the Trust, for any current Trustees unable to act

- Account card (provided by the Credit Union)

An Estate account is an account that is set up to hold the funds of an estate, or the total net worth of an individual after their death. The account is managed by the Estate’s executor.

To open an Estate account, please bring the following documents:

- Original Letters of Testamentary or Administration, no older than two years

Must be recorded in Arizona if it was issued by another state) - EIN Letter

To apply for an EIN, visit IRS.gov, search “Apply for EIN.” EINs are issued within a few minutes. - Original or certified copy of death certificate

- Account card (provided by the Credit Union)

A Representative Payee is a person who is designated by the Social Security Administration or the Department of Veterans’ Affairs to receive and manage benefits on behalf of an individual who is unable to manage the funds.

To open a Representative Payee account, please bring the following documents:

- Social Security Administration letter appointing Representative Payee OR Department of Veterans’ Affairs letter appointing fiduciary

Applications for appointment are not accepted as proof of appointment - Account card (provided by the Credit Union)

A conservatorship account is set up so a court-appointed individual can manage finances for a minor or a person who is unable to provide for their own financial needs.

To open a Conservatorship account, please bring the following documents:

- Original court order (no older than three months)

- Letters of Appointment/Authority

- Letters of Acceptance

- Account card (provided by the Credit Union)

A conservatorship account is set up so a court-appointed individual can manage finances for a minor or a person who is unable to provide for their own financial needs.

To open a Conservatorship account, please bring the following documents:

- Original court order (no older than three months)

- Letters of Appointment/Authority

- Letters of Acceptance

- Proof of Restricted Account (if applicable)

- Account card (provided by the Credit Union)

An Arizona Uniform Transfer to Minors Act account, or AZUTMA, is an irrevocable financial gift to a minor. The funds are to be used for the benefit of the minor or paid to the minor for their use.

To open an AZUTMA account, OneAZ will provide the following documents:

- Successor Custodian Designation Form (optional, provided by the Credit Union)

- Account card (provided by the Credit Union)

Do you have questions about these accounts? Our personal bankers have the answers to your questions and can assist with opening an account. They are available by appointment both in-person and virtually. To schedule an appointment, visit our Locations page.

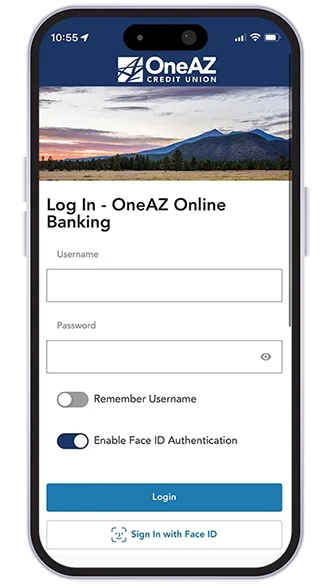

Do it all with the OneAZ Mobile Banking app.

![]()

Deposit checks

![]()

Transfer funds

![]()

Pay your bills

![]()

Chat with an associate

![]()

Locate an ATM

Download Now

Visit a Branch

Visit one of our 20 branches across Arizona to open a new account, apply for a loan or credit card, and more. We recommend scheduling an appointment prior to your visit!

Find an ATM

With your OneAZ Visa® Debit Card, you have access to 470 CULIANCE Network ATMs in Arizona and 41,343 across the nation.

We Can Help

Our team of experts is standing by to help you achieve your financial goals.

To open a new account, apply for a loan or get answers to your questions, contact our Virtual Team or make an appointment at your local OneAZ branch today.

Why Choose OneAZ?

At OneAZ, our mission is to truly improve the lives of our members, our associates and the communities we serve. By becoming a member, you’re joining a credit union that cares about your future – we are here to help you achieve your financial goals. We put you first by providing you with competitive rates, low fees and the personalized service you deserve.

- You’re a Member, not a number. Your membership is your ownership stake in OneAZ Credit Union. That means we’re accountable to you, not investors or stockholders. You have a voice in how your credit union operates and get to vote for our Board of Directors.

- Our profits are your savings. As a not-for-profit, we return our earnings to you in the form of lower interest rates, lower fees and better banking technology. Our team only cares about providing you with products and services that will benefit your financial well-being.

- We keep it local. Banking at a local credit union like OneAZ keeps your money in Arizona. We’re committed to strengthening Arizona’s economy by providing affordable home and auto loans, empowering local entrepreneurs and small businesses, and supporting our members as they achieve their financial goals.

- We invest in your community. We build stronger communities by providing support to nonprofits working in neighborhoods where our members live and work. The OneAZ Community Foundation uplifts the lives of Arizonans in need by awarding dozens of grants each year to local organizations across the state.

1 Data rates apply

Rates as of January 1, 2025.