What We'll Cover

- Your credit score reflects your borrowing behavior and helps lenders assess the risk of lending you money. A higher score indicates you're a low-risk borrower, while a lower score suggests higher risk.

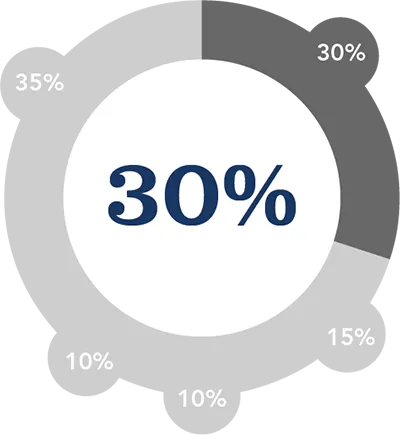

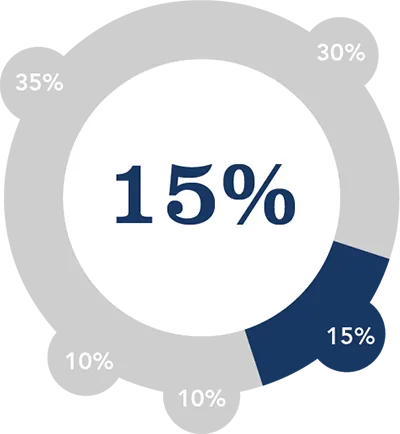

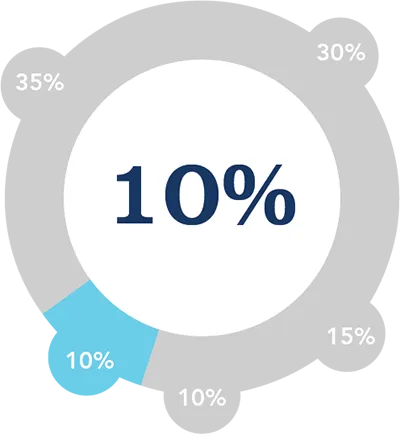

- Your credit score is calculated using five factors, each with a different weight: Payment History (35%), Amounts Owed (30%), Length of Credit History (15%), Credit Mix (10%), and New Credit (10%).

- Improving your credit score can lead to substantial savings through lower interest rates on loans.

- Just as budgeting, debt reduction, and savings are vital aspects of financial planning, maintaining a good credit score is equally crucial.

There are many pieces to a strong financial plan: creating a budget, paying off debt, saving money for emergencies and building wealth for the long term.

So where does the credit score fit in?

First off, let’s be clear that the credit score has zero correlation between your score and the amount of money you have.

There is a common myth circulating around that the higher your score, the wealthier you are. However, this is completely false. In fact, if you stopped borrowing money for ten years or more, your credit score would completely disappear.

You could have ten million dollars in the bank and yet you wouldn’t have a credit score at all.

What is a Credit Score?

Your credit score is a representation of your behavior with borrowing money and is used by potential lenders to determine your level of risk before they lend you money.

A higher score shows lenders you are a low-risk borrower and a lower score shows lenders you are a high risk borrower.

Those who are considered low risk to a lender will receive better loan terms and lower interest rates. The difference between a high score and low score could end up saving (or costing) you tens of thousands of dollars!

How Does a Credit Score Work? What Makes Up Your Credit Score

How your credit score is calculated matters more than you may think. In fact, there are five different ways your credit score is calculated and each way is weighted differently.

A common mistake borrowers make is focusing too much on the area that makes up the least portion of their score and not paying enough attention to the area that makes up the bulk of their credit score.

Below are the five different factors of a credit score listed in order of highest importance to lowest.

How is Your Credit Score Calculated?

Payment History (35%)

Your history of borrowing money and paying it back on time is the best way for lenders to decide how much they trust you.

Amounts Owed (30%)

Lenders want to see how much debt someone has compared to the amount they have available to borrow.

Length of Credit History (15%)

A longer credit history gives lenders a better idea of a borrower's behavior with borrowing money.

Credit Mix (10%)

If a lender can see the borrower is able to manage a mortgage, a student loan, and a credit card, then this makes the borrower less of a risk to the potential lender.

New Credit (10%)

New credit can both increase and decrease the overall score.

Source: Experian.com

Payment History (35%)

- A history of on-time payments will strengthen your overall credit score.

- A late payment cannot be reported to credit bureaus until 30 days after the due date. If you miss a due date, pay the late fee and don’t allow that late payment to lapse into a missed payment.

- One missed payment will stay on a credit report for seven years!

Amounts Owed (30%)

- This is also known as the credit utilization limit and it’s calculated by revolving credit.

- Revolving credit is the type of credit that is always open. These are credit cards, a home equity line of credit (HELOC) or a gas station card. With revolving credit, as soon as the loan is paid off, a borrower can immediately draw on that same line of credit, hence why it’s called revolving credit.

- Installment loan. This is a loan with a fixed term, usually in months. Once the borrower pays off an installment loan, it is automatically closed and cannot be drawn from again. Examples of installment loans are mortgages, auto loans and student loans.

- Lenders like to see a lower credit utilization percentage because it shows the borrower is responsible with managing their credit.

What is a Good Credit Utilization?

To calculate the credit utilization, simply divide the current revolving credit balance by the revolving credit limit.

Example

$2,000 (Credit Balance)

$20,000 (Credit Limit)

=

10% (Credit Utilization)

A good rule of thumb is to keep the credit utilization below 30%, however MyFICO recently reported that those with a credit score of 785 or higher had a credit utilization of 7%.

Length of Credit History (15%)

- Credit history is actually based on the following three factors:

- How long someone has had their credit accounts, including the age of their oldest, their newest, and then an average for all of their accounts

- How long someone has had specific credit accounts

- How long it’s been since someone used certain accounts

Credit Mix (10%)

- Lenders also like to see how well someone is at managing all different types of credit over time.

- Examples of a well-balanced credit mix are mortgages, personal loans, lines of credit and credit cards.

- Successfully managing a diverse mix of debt will strengthen your credit score.

- Remember, closing a credit account, like a credit card, may negatively impact your credit score.

New Credit (10%)

- Whenever a borrower applies for new credit, a lender will make a “hard inquiry” which will lower the score by a few points for a brief period of time.

- Whenever new credit is added, the average age of all credit accounts decreases, and thus negatively affects the credit history factor.

- New credit may also add a new type of credit, which would then improve the overall credit mix.

- A new revolving credit account would decrease the credit utilization percentage, thus improving your overall score again.

What is a Good Credit Score?

Source: Experian.com

Exceptional Score (800-850)

- The best loan terms

- Largest credit limits

- Lowest interest rates.

- A perfect credit score of 850 will be treated the same as a credit score of 815.

- Only 21% of Americans fall into the “exceptional score” range.

Very Good Score (740-799)

- Above average rates

- Better loan terms.

- 25% of Americans fall into this category.

Good Score (670-739)

- Access to good rates, but not always the best.

- 21% of borrowers fall into the “good” range

- 8% of this group will become delinquent borrowers.

Fair Score (580-669)

- Below 670 a borrower is considered high risk to lenders.

- Borrows in this range are considered subprime borrowers and will have a harder time getting loans approved.

- If approved, the borrower can expect higher interest rates than those with good, very good or exceptional scores.

- Currently only 17% of Americans are within the “fair score” range.

Very Poor Score (300-579)

- Focus on improving the score before applying for credit.

- Borrowers with a score below 580 will most likely be denied credit.

- This score represents a very risky borrower with a history of missed payments and poor borrowing behavior.

- If someone is approved within this range, they may have to pay an upfront fee or deposit to have access to credit.

How to Increase Your Credit Score

Increasing your credit score doesn’t have to be difficult, but it can take some time. The best thing you can do is make your payments on time each month, and never miss a payment.

If you have a credit card, make sure to at least make the minimum payment so you’re not missing payments and hurting your credit score. Late payments may cost you a fee, but a missed payment will create a large dent in your credit score. Conversely, a pattern of on-time payments will improve your credit score over time.

Beyond missed payments, the amount of debt you have on your credit report is the next largest factor affecting your credit score.

One way to boost your credit score is to lower your credit utilization ratio by focusing on the revolving credit.

Revolving Credit: These are credit cards, personal lines of credit and home equity lines of credit (HELOCs). Revolving credit is open ended, meaning there isn’t an end date. Unlike auto loans, mortgages and home equity loans, revolving credit can be accessed over and over again.

To determine your credit utilization ratio, add up the total revolving debt you have and divide that by the total available credit. For example, a revolving debt amount of $10,000 with a maximum credit limit of $20,000 equals a credit utilization of 50%.

A good rule of thumb is to work on keeping your credit utilization below 30%.

Pro Tip: Pay down the balance before the statement closing date to help improve your credit score faster. Credit companies report the balance on the account at the statement closing date, not the payment due date.

Credit Score Frequently Asked Questions

What credit score do you start with?

You start your credit history with a blank slate. If you just turned 18 and don’t have credit yet, then you simply do not have a credit score. You need at least one or two revolving credit accounts that have been active for at least three to six months to generate a credit score.

What can hurt your credit score?

- Making a late payment

- Having a missed payment – this can stay on your credit report for up to seven years!

- Having a high debt-to-credit utilization ratio

- Applying for a lot of credit at once

- Closing a credit card account

- Not having enough credit diversity

- Holding high credit card balances

What is a good credit score for a 20-year-old?

The maximum score on the FICO scale is 850, but 20-year-olds on average have a credit score ranging from 674 to 686. Remember, making payments on time will highly contribute to increasing your credit score. A 20-year-old may also consider becoming an authorized user on an account for someone who has a positive payment history to boost your credit score.

How can I check my credit score?

You can request a free copy of your credit report from each of the three major credit reporting agencies – Equifax, Experian, and TransUnion – once per year at AnnualCreditReport.com. It’s a good idea to review these annually so you can report errors or catch signs of identity theft.

Key Takeaways

- Your credit score reflects your borrowing behavior and helps lenders assess the risk of lending you money. A higher score indicates you're a low-risk borrower, while a lower score suggests higher risk.

- Your credit score is calculated using five factors, each with a different weight: Payment History (35%), Amounts Owed (30%), Length of Credit History (15%), Credit Mix (10%), and New Credit (10%).

- Improving your credit score can lead to substantial savings through lower interest rates on loans.

- Just as budgeting, debt reduction, and savings are vital aspects of financial planning, maintaining a good credit score is equally crucial.

When you’re just starting out and wondering how a credit score works and how to establish credit, remember that the best strategy is to think of your credit options as tools that are only there to help you build credit – nothing else.

Start off with a simple and straightforward credit card or a secured personal loan for quick approval and start building a history of on-time payments.

Let’s set the trend.

Start your credit journey with a OneAZ Visa Choice Rewards Credit Card.

APR = Annual Percentage Rate